Market Recap (11/23/25)

Market Recap of the Week of Nov 16, 2025 - Nov 23, 2025

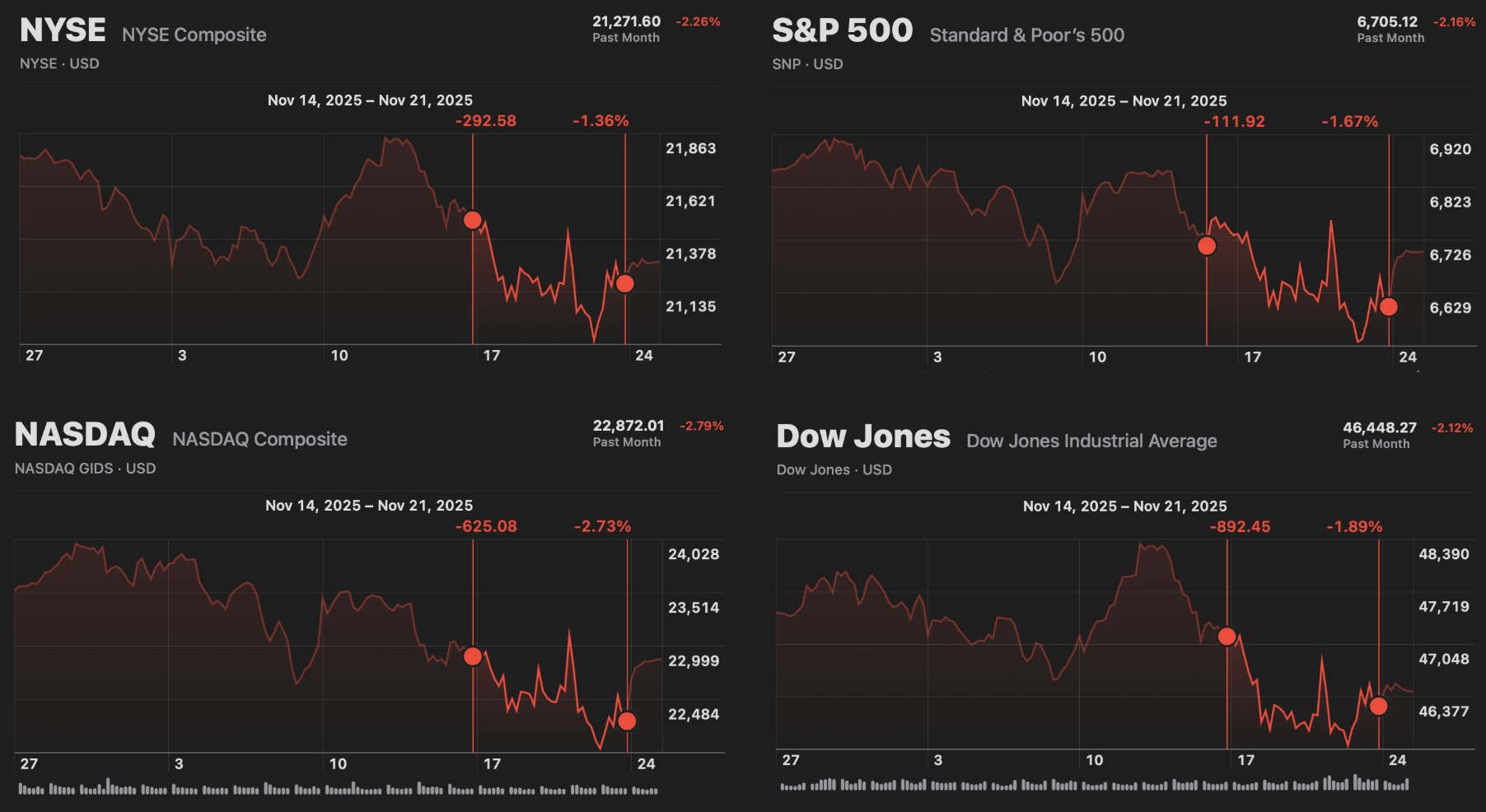

Source: Apple Stocks Application

Overall Market Trends:

The market plummeted last week, despite all four major indices rebounding towards the end of the week. The New York Stock Exchange Composite (NYSE) lost 293 points (-1.36%), the S&P 500 fell 112 points (-1.67%), the NASDAQ Composite slipped 625 points (-2.73%), and the Dow Jones Industrial Average posted a weekly loss of 892 points (-1.89%). These results were largely driven by continued concerns regarding A.I. valuations, renewed hope for a December rate cut, and weaker sentiment across tech and crypto throughout the week.

Stocks started the week off slowly, pulling back on Monday, as weakness in the tech sector continued to weigh on the market ahead of a busy week for earnings and economic data. Nvidia slipped almost 2% as investors awaited its third-quarter results, amid concerns about stretched valuations across the AI space, adding even more pressure. Other AI-linked names also struggled, including Blue Owl Capital (NYSE: OWL), which fell nearly 6% as investors questioned the payoff of the massive data center buildout, reflecting the growing doubts about the return on investment for companies that have spent heavily on computing. Outside the tech sector, Alphabet (NASDAQ: GOOG) stood out after rising more than 3% following Berkshire Hathaway's announcement of a new stake in the company.

Stocks continued to decline throughout Tuesday's session as weakness in technology dragged the market lower for the second straight day. Concerns about high valuations in the artificial intelligence space continued to pressure the major indices, with Nvidia dropping nearly 3% ahead of its earnings report, and Amazon (NASDAQ: AMZN) and Microsoft (NASDAQ: MSFT) also moving sharply lower. Bitcoin briefly dipped below $90,000, adding to the risk-off tone, as many tech investors hold large crypto positions. Nvidia’s decline this month, now over 10%, has kept investors on edge as they wait to see whether the company can justify the heavy spending tied to the A.I. buildout. A new partnership between Anthropic, Microsoft, and Nvidia failed to lift sentiment, underscoring how cautious investors have become across the sector. Outside of tech, Home Depot slipped after missing earnings and cutting its full-year outlook. By the end of the session, all three major indices closed lower, marking the S&P 500’s fourth straight decline and its longest pullback since August.

The market stabilized on Wednesday, breaking the market's four-day streak, as investors looked ahead to Nvidia’s earnings after several days of tech-driven losses. The S&P 500 rose slightly, and the Nasdaq also moved higher, helped by a strong day for Alphabet, which climbed about 3% to a new all-time high following optimism around its new AI model, Gemini 3. Nvidia gained nearly 3% as well, with analysts expecting the company to beat expectations and to guide to strong demand for its AI chips. The recent pullback in tech helped reset expectations heading into the report, which many saw as a healthier setup after the sector’s sharp run earlier this year. Even with the bounce, questions remain about whether the heavy spending on AI data centers will translate into returns quickly enough to justify valuations.

Stocks fell on Thursday as the early excitement from Nvidia’s strong earnings faded and expectations for a December rate cut continued to decline. Nvidia initially jumped after beating estimates and guiding to strong fourth-quarter sales, but the stock reversed and closed down 3% amid continued concerns about high AI valuations. Other names tied to the AI trade, including Oracle (NASDAQ: ORCL) and AMD (NASDAQ: AMD), also moved lower as investors questioned how the sector would hold up if interest rates stay higher for longer. A delayed September jobs report added even more pressure after showing stronger hiring than expected, which lowered the odds of another rate cut this year to below 40%. The shift weighed on broader sentiment and pulled the major indices deep into the red after a strong start to the session. Walmart (NYSE: WMT) was one of the few standouts, rising about 6% on solid earnings driven by growth in its e-commerce business, which added to the ongoing rotation out of expensive tech and into more defensive stocks.

The market bounced back on Friday after New York Fed President John Williams signaled that another rate cut this year is still possible. His comments suggested that policy is only modestly restrictive and could be adjusted again to bring rates closer to neutral, prompting traders to raise the odds of a December cut to above 70%. That shift helped boost stocks tied to consumer spending, including Home Depot (NYSE: HD), Starbucks (NYSE: SBUX), and McDonald’s (NYSE: MCD), as investors hoped easier policy might steady the slowing economy and support stretched tech valuations. Even with Friday’s recovery, all three major indices still finished the week with sizable losses as concerns about high valuations, weakening sentiment, and falling crypto prices kept pressure on the market.

Past Earnings Report: