Market Recap (6/8/25)

Market Recap of the Week of Jun 2, 2025 - Jun 6, 2025

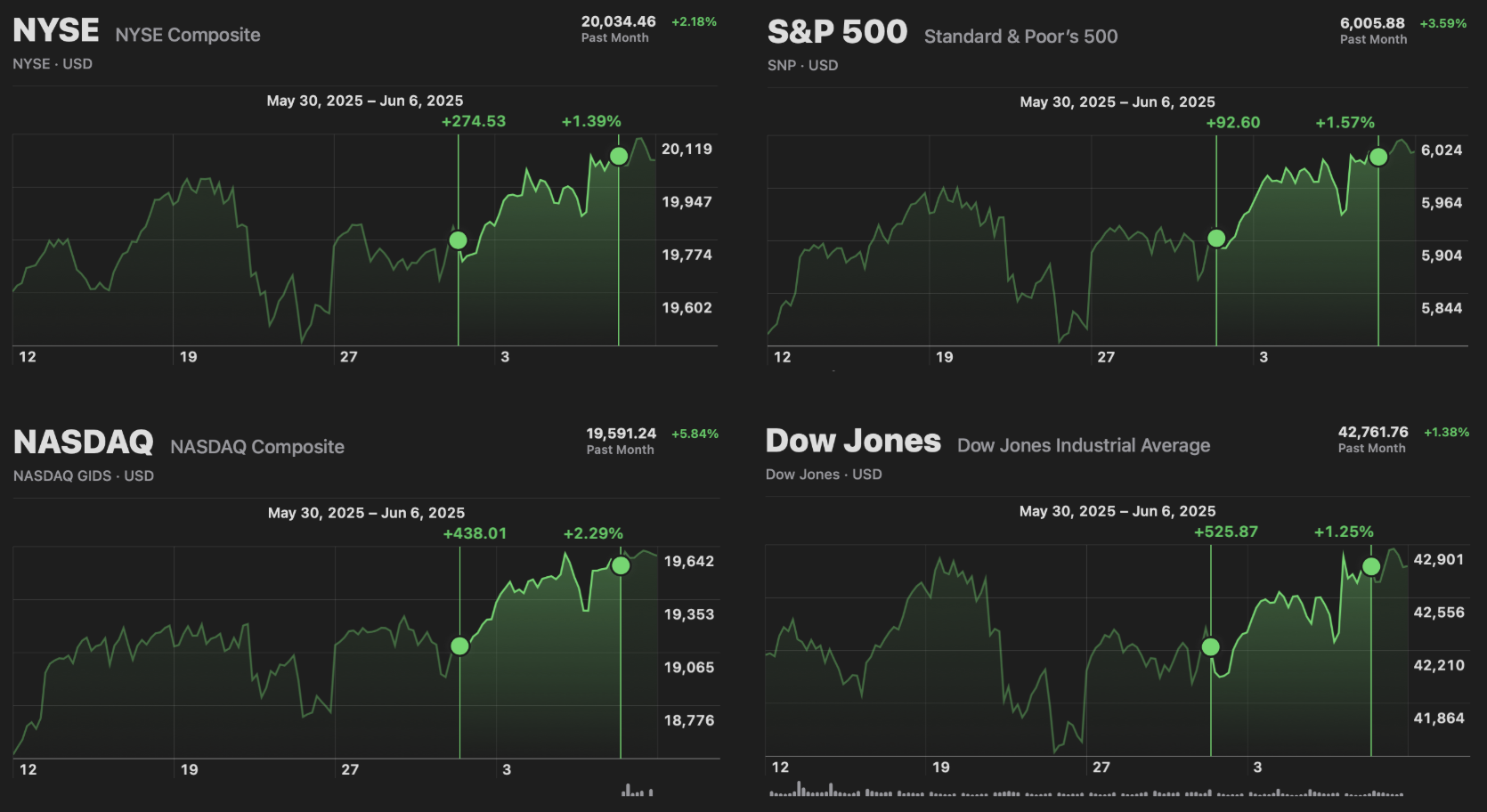

Source: Apple Stocks Application

Overall Market Trends:

The market rose last week, with all four major indices ending the week in the green. The New York Stock Exchange Composite (NYSE) rose 275 points (+1.39%), the S&P 500 climbed 93 points (+1.57%), the NASDAQ Composite soared 438 points (-2.29%), and the Dow Jones Industrial Average posted weekly gains of 526 points (+1.25%).

Stocks pushed forward on Monday despite increased global trade concerns. China defended itself against accusations from the U.S. that China had violated a trade agreement, declaring that the U.S. had instead failed to uphold the deal, indicating that negotiations are beginning to falter. Trump also mentioned raising steel levies against the EU to 50%, prompting steel companies to surge. Steel Dynamics (NASDAQ: STLD) and Nucor (NYSE: NUE) both saw 10% increases, while Cleveland-Cliffs (NYSE: CLF) saw a 23% spike.

Chip stocks helped push the market up on Tuesday. Nvidia (NASDAQ: NVDA) rose 3% while Broadcom (NASDAQ: AVGO) and Micron Technology (NASDAQ: MU) climbed over 3% and 4%, respectively.

Stocks slipped on Wednesday after a poor economic report. The payroll report showed a 37,000 increase, below the adjusted 60,000 prediction, and far under the consensus 110,000 expectation. This decreased sentiment for the highly anticipated nonfarm payroll report, set to be released on Friday. This raised concerns that the U.S. economy may be getting weighed down by trade policy uncertainty and decreased sentiment.

Indices fell on Thursday due to a sharp decline in Tesla shares. Tesla (NASDAQ: TSLA) declined over 14% after President Trump stated he was very disappointed in CEO Elon Musk, prompting a public feud between the two figures. After Musk claimed that Trump would not have won the presidential election without him, Trump called him crazy and threatened to pull Tesla’s government contracts. Additionally, President Trump initiated a phone call with Chinese President Xi Jinping and remarked that the call went well, although it is unclear if progress was made.

Stocks soared on Friday as the highly anticipated nonfarm payroll report came in greater than expected. The report displayed a 139,000 job increase, more than the 125,000 expectation, easing concerns of a potential economic slowdown. Tesla rose 3% after the downturn the day prior.

Past Earnings Report:

Looking Towards the Future

Upcoming Important Economic Events:

Monday: Wholesale inventories

Tuesday: NFIB optimism index

Wednesday: Consumer Price Index (CPI); Core CPI

Thursday: Initial jobless claims; Producer Price Index (PPI); Core PPI

Friday: Consumer sentiment (prelim)

Future Earnings Reports: