Market Recap (1/11/26)

Market Recap of the Week of Jan 4, 2026 - Jan 11, 2026

Source: Apple Stocks Application

Overall Market Trends:

The market started the year on a strong note, with all four major indices soaring throughout the week. The New York Stock Exchange Composite (NYSE) rose 365 points (+1.64%), the S&P 500 increased 108 points (+1.57%), the NASDAQ Composite climbed 435 points (+1.87%), and the Dow Jones Industrial Average posted a weekly gain of 1,121 points (+2.32%).

Markets skyrocketed to start the week off, after the U.S’ attack on Venezuela and the capture of Nicolas Maduro, the country’s leader, early that morning. Investors saw the action as a way to avoid bigger geopolitical conflicts that could upset the stock market. Energy stocks saw the largest gains as they will likely profit from rebuilding Venezuela’s oil infrastructure. Specifically, Chevron (NYSE: CVX) rose 5.1% due to its current presence in Venezuela, the country with the world’s largest oil reserves. Oilfield services companies, such as Halliburton (NYSE: HAL) and SLB (NYSE: SLB), that are able to aid Venezuela in its energy rebuild rose 7.8% and 9%, respectively. Defense giants like Lockheed Martin (NYSE: LMT) and General Dynamics (NYSE: GD) saw gains as this event proved Trump is not afraid ot use quick military strikes to deal with geopolitical issues that may arise.

Stocks continued to rise on Tuesday, carried by the magnificent seven and artificial intelligence companies, such as Amazon (NASDAQ: AMZN), Micron Technology (NASDAQ: MU), and Palantir Technologies (NASDAQ: PLTR).

The stock market pulled back on Wednesday, led by the financials and energy sectors that started the year off strong. Defense stocks also fell after President Trump announced that these companies will not be allowed to issue dividends or stock buybacks until they address some issues he has made remarks about.

Thursday saw mixed results as the NASDAQ fell due to a decline in technology stock prices, while the Dow Jones rose. Trump called for a $1.5 trillion defense spending budget for 2027, a sharp increase from 2026’s congressionally approved budget of $901 billion, causing defense stocks to jump.

The market rose on Friday despite a new labor report released that morning coming in weaker than expected. Nonfarm payrolls increased by 50,000 last month, far below the 73,000 anticipated. This new data indicates that investors are still expecting economic growth to accelerate, despite the U.S. economy's slow progress. The unemployment rate fell to 4.4%, below the 4.5% estimate.

Past Earnings Report:

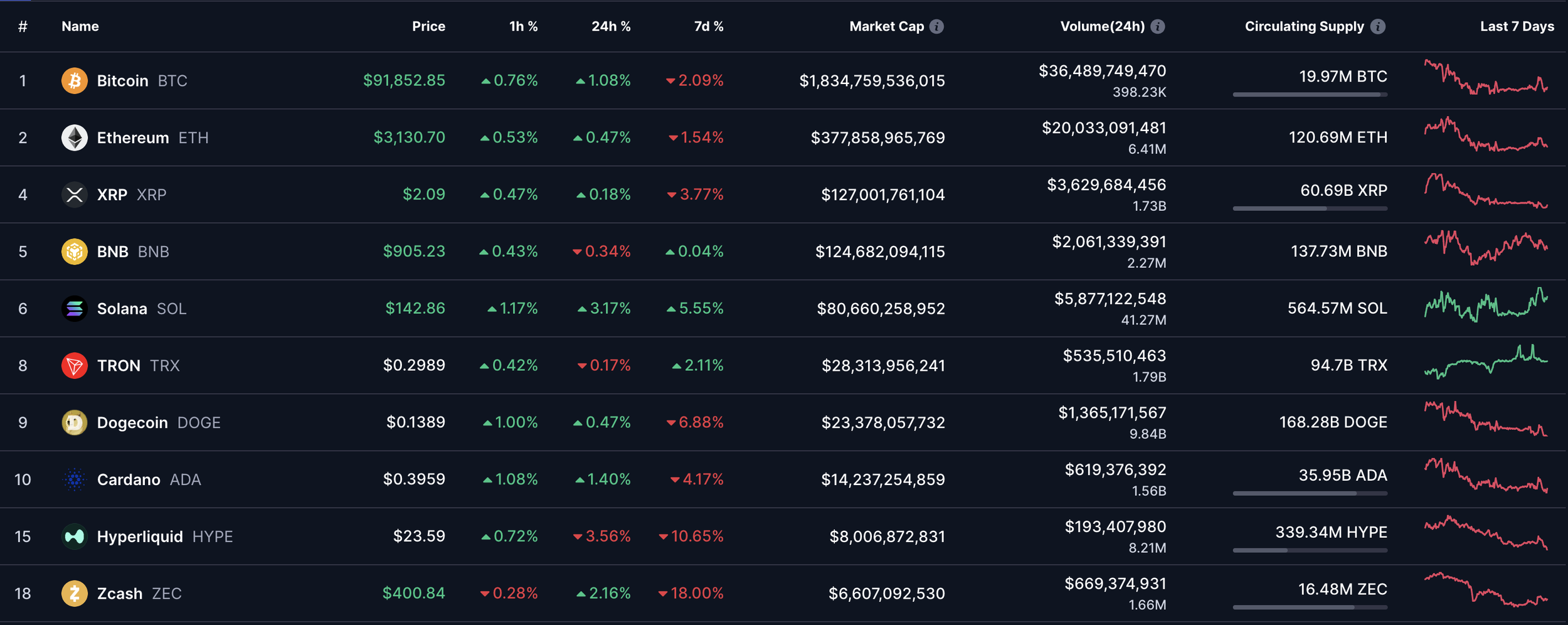

This Week in Crypto

Source: CoinMarketCap

Market Trends:

The crypto market started the year off on a sour note, finishing slightly lower after several sharp moves from volatile trading throughout the week. The total crypto market cap fell just under 3 percent. Bitcoin (BTC) ended the week around $91,850, down roughly 2 percent, while Ethereum (ETH) slipped about 1.5 percent to $3,130. Most major altcoins also finished lower, although performance varied widely depending on the sector and timing of the moves. While the market was able to avoid a major sell-off, it failed to sustain any momentum despite starting the week off strong. These results were largely influenced by strong macro data, ETF flow reversals, and a sizeable derivatives unwind which kept prices rangebound, leaving the market modestly lower by week’s end.

Crypto started the week off strong as prices rallied early on: Bitcoin pushed back into the low-to-mid $90,000 range, with Ethereum following suit as optimism shortly returned to riskier markets such as crypto. ETF inflows early in the week helped support prices, and investors rotated into select altcoins, particularly Layer-1 networks and AI-related tokens. Names like Solana and XRP outperformed during this stretch as traders leaned back into higher-beta opportunities.

This surge, however, began to fade as the week progressed. Risk appetite was shaken after new U.S. labor data came back fairly strong and rate cut expectations diminished, causing crypto to fall. Simultaneously, people flocked towards futures markets, leading to a wave of liquidations, therefore accelerating the pullback. Bitcoin ultimately slipped back toward the low $90,000s and dragged much of the market with it, erasing a large portion of the earlier gains.

By the end of the week, the market had relatively stabilized, with momentum remaining limited. Bitcoin managed to hold above the $90,000 mark, and Ethereum stayed above $3,100 as selling pressure eased. Trading volumes have cooled compared to the start of the month. Derivatives funding was also relatively neutral, signalling that traders were less aggressive with directional bets. While prices rebounded modestly, there was not enough conviction to push the market meaningfully higher.

Institutional flows played an important role throughout the week. Bitcoin and Ethereum spot ETFs saw solid inflows early on, which helped fuel the initial rally, but those inflows later reversed as sentiment cooled. Without consistent institutional demand, Bitcoin struggled to break above resistance, which kept the broader market in check. As a result, trading became more selective, with investors favoring specific narratives rather than the market as a whole.

This rotation was visible in the altcoin sector. Solana (SOL) finished the week higher, supported by renewed interest in high-throughput networks, while XRP also held up relatively well. On the other hand, however, tokens like Cardano (ADA) and Dogecoin (DOGE) ended the week lower as sentiment weakened and supply pressures stayed relevant. This pressure only grew as several projects had token unlocks this week despite the uneven liquidity in the market.

Live Crypto Markets:

Looking Towards the Future

Upcoming Important Economic Events:

Monday: Various Fed Presidents speak

Tuesday: NFIB optimism index • U.S. Consumer price index (CPI) • Core CPI

Wednesday: U.S. Producer price index (PPI) - delayed report • Core PPI

Thursday: Initial jobless claims • Empire state manufacturing survey • U.S. import prices (delayed report)

Friday: Industrial production • Capacity utilization

Future Earnings Reports: